So Many Cash Discount Receipts

A major contributor to the compliance of a cash discount is the receipt. Why? Because it’s a binding paper document that represents the agreement you entered into when you decided to exchange consideration, payment, money, etc., for goods offered by a merchant.

That’s a mouthful! We typically don’t consider that we’re entering into an agreement when we buy something. We just think – here’s my money, thanks for the (fill in the blank)!

And when you really think about it, that piece of paper (or email) lets you walk out of that establishment and not be tackled by a security guard for shoplifting. The merchant has witnessed to you that you can take that ‘good’ and leave – no strings attached.

IF YOU’RE A MERCHANT

- Are you representing the agreement?

- Are you representing it correctly?

- Are you being a competent merchant and looking out for not only yourself, but for your customer who has placed their trust in you?

If you are, then you’re tendering a receipt with the purchase that contains a written description of the fees, services and discounts you’ve provided to the customer.

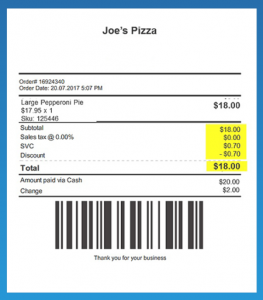

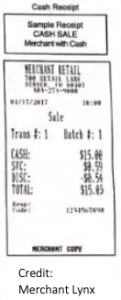

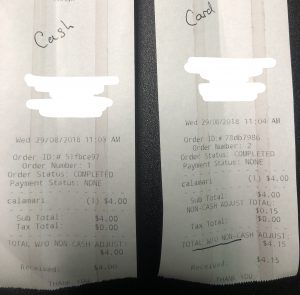

Here are a few examples that display these written communications:

1.

2.

3.

WHY ARE THERE SO MANY VARIATIONS?

This is one of the most hot-button debates and topics of discussion being batted around today. Cash discount offers are relatively ‘new’ and have gained a significant amount of popularity over the last few years. The processing industry as a whole, this is the very start of a new tool that ISO’s and merchants can deploy to ultimately increase the bottom line of the merchant.

Because of the newness of this program, some things are still being standardized to ensure fairness and clarity for all parties involved.

Multiple variations for receipt formats are currently used, currently accepted and currently questioned as to their compliance. What is known for sure at this time is that proper signage and receipt are must haves! If a merchant opts to forego these two critical pieces, and they’re called into question because of a charge that doesn’t look right, there could be severe ramifications to that merchant.

WHICH IS CORRECT?

The type of receipt will vary from Poynt to Clover to Dejavoo. Which is correct?

Well, that’s the point of this discussion, isn’t it? The short answer – It’s still a work in progress.

First, go to your agent, if you’re a merchant. ISO’s / Processors are becoming more educated and compliant in their efforts to support your business in its growth with additional revenue from a good cash discount program. At Cash Discount, we have listed some of the top processors for you if you are still trying to get a grasp on whether this program is right for your business. Feel free to check them out!

If you’re an ISO, it’s best to check with your bank, card brand and perhaps your legal counsel to ensure you’re covering all angles. Truth be told, according to the Durban Amendment of the Dodd-Frank Act of 2010, a merchant is not to be restricted from participating in a cash discount activity. However, card brands like Visa are imposing their own rules in an effort to establish some consistency and protection for both the ISO and the merchant.

COVER YOUR ASSETS

At the end of the day, you’ll want to check with your agent as to whether the solution you are using is sufficient for compliance. If they don’t know, they should be very happy to find out for you. And if they won’t, don’t leave it to chance!

You don’t want to find yourself on the wrong side of an audit or secret shop. Instead, go find a processor that has a solid understanding of the program. Again, we’ve done the work for you – they can be found here.

Damon Luke, CEO

Cash Discount

Leave a Reply

Want to join the discussion?Feel free to contribute!