Cash Discount Processor Review – Slice Payments

Request A Call

Call 844-296-2160

Slice Payments

Overview

Slice (Slice Business Marketing Inc.) came into being at the beginning of 2019 and has dedicated itself primarily to merchants looking to reduce their fees. Understand, however, that though Slice is a newer entity, the management team has 25 years of combined experience serving merchants in the payments industry. Slice is accredited with the BBB and has a rating of A- with two 5-star reviews and no customer complaint – so they’re off to a great start.

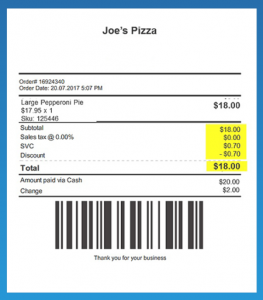

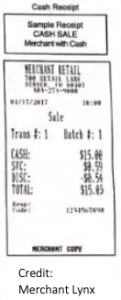

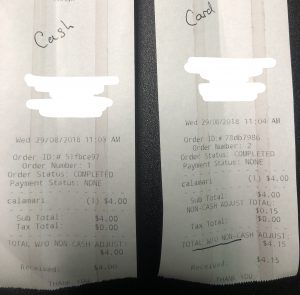

The first thing we want to point out about Slice Business Marketing Inc. is that they are first and foremost a cash discount-oriented company. Their main focus is to work with merchants that share their same vision in cutting back fees to as little as possible. Their goal, as shown on their site, is to provide a merchant with zero processing fees. Now, that may not always or ever be the case, but that’s what they are committed to doing and it’s only through a qualified cash discount program that merchants can accomplish it.

When you partner with Slice, you benefit from their proprietary software that gets you started immediately offering cash discount, as well as ensures you’re compliant to legislative and card brand requirements.

Credibility

They are saddled with Wells Fargo which goes to show there is plenty of business credibility for you to share in. When you look at what all they offer, it’s clear to see that they have thought a lot of things through to make sure the merchant is confident in the solutions, as well as has access the options they may need without having to piece a solution together from multiple resources.

Full-service

Another piece they offer is working capital. Some agents represent a one-product ISO which limits your options as your business evolves and grows. You’ll want to consider where your business is going and what options you’ll need and whether your current processor can manage those transitions for you? Having this option at your fingertips can help obtain capital from someone who knows your business and knows how to get it to you quickly.

As an added benefit, they’re very familiar with traditional processing and surcharging so they can counsel with you on what is the best method for you to transact business to keep fees down and stay within regulations. Our experience in communicating with them has been excellent! They are a hungry firm, not for your money, but to share what they’ve learned in this exciting time where cash discount programs are taking flight.

Hardware

- Slice offers the following options:

- Standalone terminals – Pax and Dejavoo

- CloverTM POS Family

- Slice POS

- Aldelo POS

- Paradise POS

- More…

Services

All of their services are focused on reducing or eliminating your processing fees where possible:

- Surcharge-ready

- Hardware

- EMV

- Virtual Terminal

- Debit Services

- Credit Services

- No Contract

- E-Commerce Processing

- Business Capital up to $500,000

- Credit & Debit Card Processing

Customer Support

Responsiveness is the word that comes to our mind. They are anxious to help their clients get started, of course, and keep running! From what we have experienced with the management team and their past reputation, they employ hard working associates that will chase down a solution and make sure their merchant is protected. No processor will ever be perfect, but it’s apparent they are aimed for perfection and have the merchant’s loyalty in mind.

To back that up, you can reach them by email or form on their site, as well as they have a phone number that will ring to an available agent to ensure your needs are met as quickly as possible.

Summary

We love what Slice is doing! We love how versatile they are and that they’re not held back by traditional bureaucracy. The landscape is changing in the payments industry and merchants need someone who can adapt, Slice is that option. They are a great option for any size business whether you’re looking for cash discount processing, add-on features, or business capital.

They are focused on getting a merchant on a zero-fee program which is great news for the segment this really applies to. However, if you discover that a cash discount program isn’t a good fit, then you still have all of the options at your fingertips. We like their approach, feel they have the infrastructure to support merchants completely, and are really excited to see how they progress.

Cash Discount Team

E: [email protected]

W: www.cashdiscount.com